Loading

Get 941p Pv Me

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 941p Pv Me online

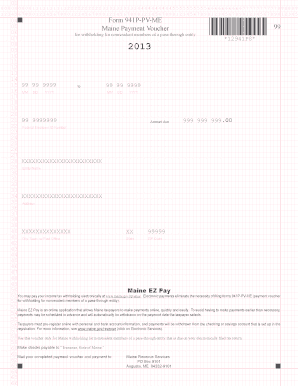

The 941P Pv Me form is essential for withholding payments for nonresident members of a pass-through entity in Maine. This guide provides a step-by-step explanation to help users complete this form online with confidence.

Follow the steps to fill out the 941P Pv Me online effectively.

- Press the ‘Get Form’ button to access the form and open it in an online editor.

- Enter the Federal Employer ID Number in field 22. Ensure that this number is correct, as it identifies your business for tax purposes.

- In field 29, input the entity name associated with the payment. This should match the name on file with the Maine Revenue Services.

- Provide the mailing address for the entity in fields 35-41. Include the street address, city or town, state, and zip code.

- Complete field 21 by entering the total amount due for withholding. This should reflect the accurate payment for the reported period.

- Verify all entries for completeness and accuracy before proceeding to the next step.

- After ensuring that all information is filled out correctly, save your changes. You can also download, print, or share the completed form as needed.

Begin completing your 941P Pv Me form online today.

Yes, you can file your 941 report electronically using the IRS e-file system. This option allows for quicker processing and reduces the chances of errors associated with paper forms. Many people find it convenient to use platforms like uslegalforms, which provide step-by-step guidance to ensure that your filing goes smoothly and complies with all requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.