Get 2012 Instructions For Form R 6922

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Instructions For Form R 6922 online

This guide provides clear and detailed instructions for completing the 2012 Instructions For Form R 6922 online. Designed for partnerships engaging in activities in Louisiana, this form is essential for those with nonresident partners to accurately report income.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to acquire the form, which will open it in a suitable online editor.

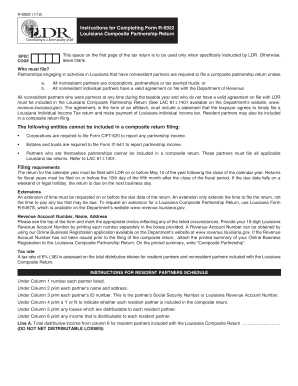

- Review the initial information at the top of the form. If applicable, mark the appropriate circles indicating your filing circumstances.

- Enter your 10-digit Louisiana Revenue Account Number in the designated boxes. If you have not obtained this number, ensure to attach a printed summary of your Online Business Registration.

- List each partner according to the instructions provided in the Resident Partners Schedule section. Number each partner in Column 1, and print their name and address in Column 2.

- In Column 3, input each partner's ID number, which may be their Social Security Number or Louisiana Revenue Account Number. Indicate in Column 4 whether they are included in the composite return.

- Document any distributable losses in Column 5 and distributable income in Column 6 for each resident partner.

- Follow the same process for nonresident partners in the Nonresident Partners Schedule section, paying special attention to the requirements for Column 4 regarding valid agreements.

- Complete the Summary of Tax Paid on Behalf of Partners section by inputting totals from the Resident and Nonresident Partners Schedules.

- Calculate the amount due in the Computation of Amount Due section, ensuring correctness with respect to payments made and overpayments.

- When you have entered all the relevant information, you can save the changes, download the completed form, print it for your records, or share it as needed.

Start completing your documents online today to ensure timely and accurate filing.

You can obtain Louisiana state income tax forms directly from the Louisiana Department of Revenue's website. They provide downloadable versions in PDF format, making it easy for you to access the necessary paperwork. Additionally, local libraries and tax preparation offices often carry these forms. For comprehensive guidance, consider reviewing the 2012 Instructions For Form R 6922 to ensure proper form filling.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.