Loading

Get 2013 Louisiana Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Louisiana Tax Forms online

Filing your Louisiana tax forms online can streamline the process and help you manage your taxes more efficiently. This guide provides a step-by-step approach to completing the 2013 Louisiana Tax Forms accurately and easily.

Follow the steps to complete your tax forms online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

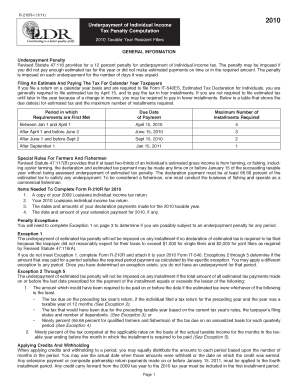

- Review the general information section to understand the underpayment penalty and the requirements for filing estimated tax payments.

- Gather necessary materials such as your previous year's tax return, current year's tax return, and payment details.

- Navigate to Section 1 of the form to compute your required annual payment based on your 2010 income tax liability.

- Complete the calculations on Lines 1-4, ensuring you derive the correct payment amounts for each installment.

- Move to Section 2 and record the pertinent details regarding your underpayment conditions, filling in Lines 5-9 accurately.

- Proceed to Section 3 and evaluate if you qualify for any exceptions by reviewing Lines 10-14.

- If necessary, calculate penalties in Section 4 according to Lines 15-19 to determine if any underpayment penalties apply.

- Review the entire form for accuracy and completeness before finalizing.

- Once satisfied, save changes, download, print, or share the form as needed.

Complete your tax documents online now for a faster and more efficient filing experience.

To file an old tax form, start by downloading the appropriate 2013 Louisiana Tax Forms from a reliable source. Next, fill them out accurately, making sure to include any necessary attachments. Afterward, mail them to the IRS or the state tax authority. If you encounter any difficulties, US Legal Forms is a great resource for those looking for guidance and examples.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.