Loading

Get File Online R 16019 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the File Online R 16019 Form online

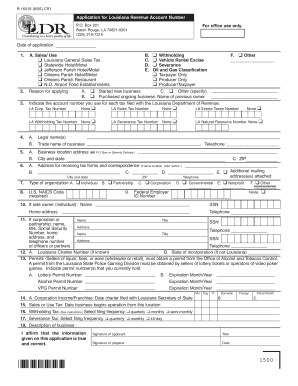

Filling out the File Online R 16019 Form is an essential step in applying for a Louisiana Revenue Account Number. This guide will provide you with clear, step-by-step instructions to help you navigate the online form efficiently.

Follow the steps to complete the online form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the date of application in the designated field.

- In Section A, select the type of tax you are applying for by checking the appropriate box (e.g., Louisiana General Sales Tax).

- In the next section, provide the reason for applying by selecting the appropriate option or specifying if it is 'Other'.

- If applicable, indicate the account numbers you use for each tax filed with the Louisiana Department of Revenue.

- Enter the legal name and trade name of your business in the respective fields.

- Provide the business location address, including city, state, and ZIP code.

- Fill in the address where you would like to receive tax forms and correspondence, ensuring no P.O. Box addresses are included.

- Select your type of organization from the options provided (e.g., Individual, Partnership, Corporation). Make sure to include the U.S. NAICS Code.

- If you are the sole owner, provide your name, Social Security Number (SSN), and home address.

- If your business is a corporation or partnership, list the names, titles, SSNs, and addresses of the officers or partners.

- Fill in the Louisiana Charter Number and state of incorporation if applicable.

- If you are a seller of liquor, beer, or wine, indicate the relevant permit numbers you currently hold and their expiration dates.

- Provide the corporation income/franchise date filed with the Secretary of State.

- Indicate the date your business begins operation from this location.

- Select your withholding tax filing frequency (quarterly, monthly, or semi-monthly).

- Select your severance tax filing frequency (quarterly, monthly, or 45-day).

- Provide a brief description of your business.

- Finally, affirm that the information provided is true and correct by signing the application and including the date.

- Once you have completed the form, ensure to save changes, download, print, or share the form as needed.

Take the next step and complete your forms online for a smoother application process.

To get your 2019 tax return online, you can use online tax software if you filed electronically, or you can access it through the IRS website by using their 'Get Transcript' tool. You will need to verify your identity using your personal information. If you’re looking for additional guidance, utilizing U.S. Legal Forms can help streamline the process to File Online R 16019 Form effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.