Loading

Get R1344 Exemption Certificate Instructions La

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R1344 Exemption Certificate Instructions La online

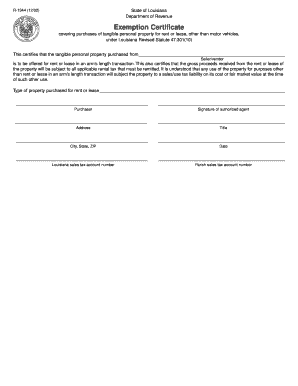

The R1344 Exemption Certificate is essential for certifying that tangible personal property purchased will be offered for rent or lease. This guide provides clear, step-by-step instructions for completing this form online, ensuring compliance with Louisiana tax regulations.

Follow the steps to complete your R1344 Exemption Certificate online.

- Click the ‘Get Form’ button to access the R1344 Exemption Certificate and open it in your chosen digital editor.

- Enter the name of the seller or vendor from whom you are purchasing the tangible personal property. This information is crucial for documenting the transaction.

- Specify the type of property purchased for rent or lease in the designated field. Be as detailed as possible to avoid confusion.

- Provide your name or the name of the entity purchasing the property in the section labeled 'Purchaser'.

- Fill in the address, including the city, state, and ZIP code associated with your business or personal address.

- Enter your Louisiana sales tax account number. This number is necessary for processing and tax reporting purposes.

- An authorized agent must sign the form. Enter their full name as well as their title.

- Indicate the date when the form is completed.

- Include the parish sales tax account number if applicable.

- Once all fields are completed, save your changes, and download or print the form for your records. You may also choose to share it as necessary.

Complete your R1344 Exemption Certificate online today to ensure compliance with Louisiana tax laws.

To obtain a Louisiana resale certificate, you can begin by visiting the Louisiana Department of Revenue's website. You will need to fill out and submit an application form, providing the necessary business details. Following the R1344 Exemption Certificate Instructions La will help you complete the form correctly and increase your chances of approval.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.