Loading

Get Lgst 9 D

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lgst 9 D online

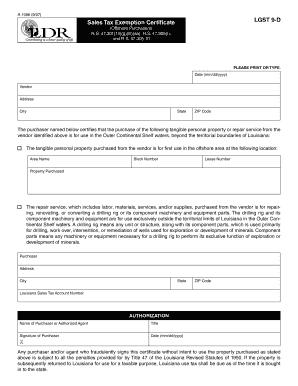

The Lgst 9 D is a sales tax exemption certificate specifically designed for offshore purchasers in Louisiana. Completing this form correctly is essential for ensuring tax exemptions on purchases made for use in the Outer Continental Shelf waters.

Follow the steps to fill out the Lgst 9 D online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital platform.

- Enter the date in the format mm/dd/yyyy at the top of the form. This establishes when the exemption is claimed.

- In the vendor section, provide the vendor's name, complete address, city, state, and ZIP code. Accurate details ensure proper documentation.

- Next, indicate that the purchase is for tangible personal property or repair services intended for use in the Outer Continental Shelf. Specify the location of first use including the area name, block number, and lease number if applicable.

- List the property purchased, completing any details pertinent to the repair service including labor, materials, or equipment required for the drilling rig or its components.

- In the purchaser section, input the name, address, city, state, and ZIP code of the purchaser. Also, include the Louisiana sales tax account number which is essential for tax record purposes.

- Provide the name of the purchaser or authorized agent signing the certificate, along with their title. This clarifies who is responsible for the form.

- Sign and date the form in the designated section. Ensure that the date is entered in the format mm/dd/yyyy. This confirms the authorization of the exemption.

- Once all fields are completed, review the information for accuracy. After confirming correctness, save changes to your document. Download, print, or share the completed form as needed.

Complete your documents online today to streamline the process and ensure compliance.

In Arkansas, certain entities qualify for sales tax exemption, such as nonprofit organizations, schools, and government agencies. Additionally, purchases for resale are generally tax-exempt. It’s important to possess the necessary documentation to prove your exempt status when making purchases. Using resources like USLegalForms can help clarify these qualifications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.