Loading

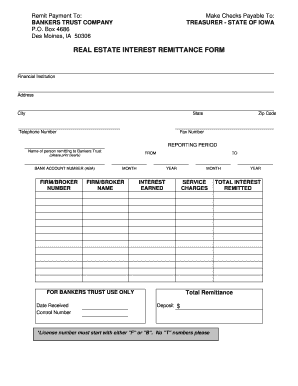

Get Real Estate Interest Remittance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Real Estate Interest Remittance Form online

This guide provides a step-by-step approach to completing the Real Estate Interest Remittance Form online. By following these instructions, users can efficiently navigate each section of the form to ensure accurate submission.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out the financial institution section. Enter the name of the bank, which in this case is 'Bankers Trust Company'.

- Proceed to the address field. Clearly enter the bank's mailing address, including the P.O. Box, city, state, and zip code.

- In the telephone number field, enter a valid contact number for the financial institution.

- Next, complete the reporting period section, indicating the name of the person remitting to Bankers Trust. Enter the period start and end dates in the provided fields.

- Fill in the bank account number (ABA). Use the appropriate format and ensure accuracy.

- Enter the firm or broker number as required, ensuring it begins with either 'F' or 'B'.

- Provide the month and year for the reporting period. Review the start and end dates to ensure consistency.

- Indicate the total interest earned during the reporting period in the designated field.

- For bank use only, ensure the date received and control number sections remain blank. These will be filled by the bank.

- Finally, summarize any service charges if applicable and ensure the total interest remitted is accurate.

- Once all fields are completed, save your changes. You may choose to download, print, or share the form as needed.

Complete your Real Estate Interest Remittance Form online today for a hassle-free filing experience.

Related links form

To claim mortgage interest on your taxes, you will need to include the amount from your 1098 form on your tax return. Most taxpayers file this information on Schedule A, where you itemize your deductions. Having a Real Estate Interest Remittance Form can help you stay organized and ensure you capture all relevant details for a successful filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.