Get Information Bulletin #8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INFORMATION BULLETIN #8 online

This guide provides clear instructions on how to effectively fill out the INFORMATION BULLETIN #8 related to sales tax, specifically focusing on computer hardware, software, and digital goods. By following these steps, you can ensure accurate and complete submission of the necessary information.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the INFORMATION BULLETIN #8 and open it for completion.

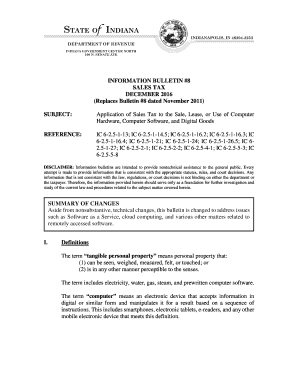

- Begin by carefully reading the introduction and summary of changes in the form. Make sure you understand the context and latest updates regarding sales tax application to computer hardware, software, and digital goods.

- Proceed to the definitions section. Familiarize yourself with key terms such as ‘computer hardware’, ‘computer software’, and ‘specified digital products’ as this information is crucial for proper completion of the form.

- Continue to fill out any required fields related to your specific situation, such as purchase details or lease information for computer hardware and software, ensuring accuracy in your entries.

- Review any guidance provided in the sections that pertain specifically to your purchases or usage. Pay attention to examples given, as they can help clarify your obligations regarding sales tax.

- Once all necessary sections have been filled out, ensure that you review your entries for accuracy and completeness.

- Finally, you can save your changes, download the completed form, print it for your records, or share it as needed.

Complete your INFORMATION BULLETIN #8 today to ensure compliance and avoid potential issues.

The SS-8 form serves the purpose of determining a worker's classification for tax purposes and clarifying responsibilities for both employers and employees. It's a proactive step for individuals or businesses looking to ensure compliance with tax laws. For further insights into its importance, refer to the INFORMATION BULLETIN #8, which outlines steps and benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.