Loading

Get 2013 In Urt Qtly Estimated Payment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 In Urt Qtly Estimated Payment Form online

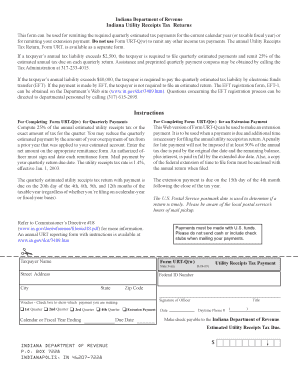

Filling out the 2013 In Urt Qtly Estimated Payment Form is essential for ensuring accurate tax payments for utility receipts. This guide will provide clear, step-by-step instructions to help you confidently complete the form online.

Follow the steps to efficiently complete the form online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Begin by entering your taxpayer name in the designated field, ensuring that it matches your official records.

- Fill in your street address, including apartment or unit number if applicable, followed by your city, state, and zip code.

- Provide your federal ID number in the respective field, which is required for tax identification purposes.

- Select the appropriate checkbox for the voucher that reflects the quarter for which you are making a payment, or if it's an extension payment.

- Indicate whether you are filing for a calendar or fiscal year ending in the provided field.

- Calculate your estimated utility receipts tax due, which is typically 25% of your annual estimated tax, and enter this amount in the designated box.

- Sign and date the form in the sections marked for the signature of an authorized officer. Ensure that the title and daytime phone number are also included.

- Once all fields are completed, save your changes. You can then download, print, or share the form as needed.

Start filling out the 2013 In Urt Qtly Estimated Payment Form online to ensure your tax obligations are met in a timely manner.

Quarterly payments occur every three months, which means you will have four due dates each year. These payment periods help you manage your tax liability without facing a big bill at the year’s end. Keeping track of these dates is crucial for staying compliant and avoiding interest on late payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.