Loading

Get Timber Release

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Timber Release online

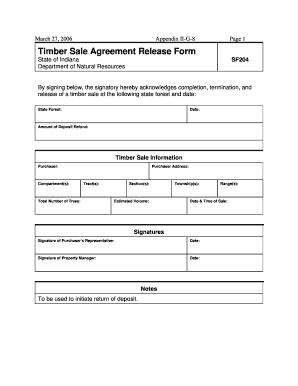

The Timber Release form is essential for documenting the completion and release of a timber sale in Indiana. This guide will help users of all experience levels navigate the process of filling out the form online.

Follow the steps to successfully complete the Timber Release form.

- Press the ‘Get Form’ button to access the Timber Release form and open it in your preferred editor.

- Locate the section labelled 'State Forest' and enter the name of the specific state forest where the timber sale took place.

- Enter the 'Date' of the timber sale in the designated field, ensuring the format is correct.

- In the 'Amount of Deposit Refund' field, input the total amount that is being refunded to the purchaser.

- Fill in the 'Purchaser' section with the name of the individual or entity who purchased the timber.

- Complete the 'Compartment(s)' section by indicating the compartment numbers associated with the timber sale.

- Provide the 'Purchaser Address', ensuring it is complete and accurate.

- In the 'Tract(s)' field, list the tract numbers relevant to the sale.

- Record the 'Total Number of Trees' sold during this timber sale.

- In the 'Section(s)' field, specify the section numbers pertaining to the forest.

- Indicate the 'Estimated Volume' of timber sold, documented in appropriate units.

- Enter the relevant 'Township(s)' for the timber sale.

- Document the 'Date & Time of Sale' accurately.

- The 'Signature of Purchaser’s Representative' must be filled out, followed by the date of signing.

- Have the 'Signature of Property Manager' completed, along with the date of signing.

- Finally, review the form for accuracy. You can now save changes, download, print, or share the completed form as needed.

Complete your Timber Release form online today to streamline your documentation process.

Timber can be depreciated under certain circumstances, generally when it is considered a business asset. For individuals utilizing the Timber Release process, depreciation may vary based on how the timber is managed and sold. Proper accounting practices and guidelines from the IRS will help determine the depreciable status of your timber. For more in-depth assistance, consider exploring resources from platforms like uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.