Get Personal Property Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Property Forms online

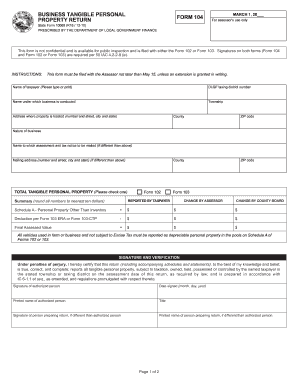

Filling out the Personal Property Forms online is a crucial step in reporting your business's tangible personal property. This guide will walk you through the process, ensuring you understand each component of the form and how to complete it accurately.

Follow the steps to complete your Personal Property Forms online.

- Click the ‘Get Form’ button to access the form and open it in a digital editor. This is your first step in obtaining the necessary document.

- Begin filling out the form by entering your name as the taxpayer. Make sure to either type or print clearly in the designated section.

- Provide your DLGF taxing district number in the next field. This number is essential for proper identification of your property location.

- Indicate the name under which your business is conducted. This should be the name registered with the appropriate authorities.

- Enter the township where your property is located. Accurate identification of the location is necessary for tax purposes.

- Fill in the address where the property is situated, including the number and street, city, state, and ZIP code.

- Specify the nature of your business in the provided area. This gives context to the property being reported.

- If different from the taxpayer’s name, provide the name to which the assessment and tax notice should be mailed, along with the corresponding mailing address.

- Choose the total tangible personal property form you are submitting (Form 102 or Form 103) by checking the appropriate box.

- Complete the summary section by inputting the assessed values and deductions as outlined in the form. Ensure all numbers are rounded to the nearest ten dollars.

- In the signature and verification section, certify the accuracy of the information by providing your signature, date, and printed name as the authorized person.

- If a different person prepared the return, enter their signature and printed name in the designated fields.

- Review all the filled sections carefully to detect any errors or missing information before final submission.

- Once satisfied, save your changes, and choose to download, print, or share the completed form as needed.

Start completing your Personal Property Forms online today to ensure timely and accurate reporting.

In Indiana, personal property encompasses items not fixed to land, such as vehicles, furniture, and equipment. These items typically include business personal property, which can affect local tax assessments. It's essential to distinguish personal property from real estate, as different rules apply. Using Personal Property Forms can assist you in accurately defining your assets and ensuring compliance with local regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.