Loading

Get Rmft 11 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rmft 11 A online

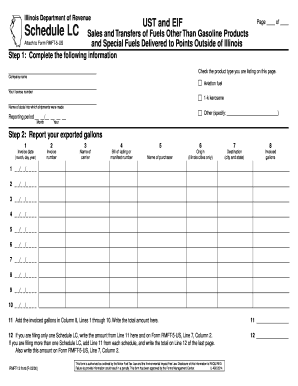

Filling out the Rmft 11 A form is an essential task for reporting sales and transfers of fuels other than gasoline. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, whether you have prior experience or are new to the process.

Follow the steps to complete the Rmft 11 A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your company name and license number in the designated fields. Specify the product type you are reporting, selecting from options such as aviation fuel and 1-k kerosene. Ensure that you list only one state and one product type per page.

- Indicate the reporting period by filling in the month and year in the appropriate fields.

- In the section for reporting your exported gallons, complete Lines 1 through 10 by providing the following details: invoice date (month, day, year), invoice number, name of carrier, bill of lading or manifest number, name of purchaser, the Illinois city of origin, destination city and state, and the number of invoiced gallons.

- Add the invoiced gallons from Column 8, Lines 1 through 10. Write the total amount in Line 11.

- If you are filing only one Schedule LC, write the amount from Line 11 on Line 12. If filing more than one Schedule LC, total the amounts from Line 11 of each schedule, and write the total in Line 12 of the last page.

- Ensure you have provided all required information and double-check for accuracy.

- Once completed, you can save changes, download, print, or share the form as needed.

Start filling out your Rmft 11 A online today!

The simplest way to claim your taxes back is to file your return accurately and on time. Utilize tax software or professional services to ensure you capture all eligible credits and deductions. Often, platforms like uslegalforms can provide streamlined options to help you navigate the process efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.