Loading

Get Il505 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL505 Form online

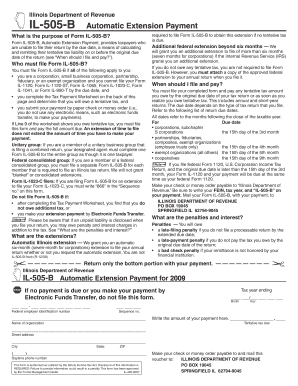

The IL505 Form, known as the Automatic Extension Payment, allows taxpayers to calculate and remit their tentative tax liability if they are unable to file their return by the due date. This guide offers clear, step-by-step instructions on how to complete the form online, ensuring a smooth and accurate filing process.

Follow the steps to accurately fill out the IL505 Form online.

- Click the ‘Get Form’ button to obtain the IL505 Form and open it for editing.

- Locate the tax year field at the top of the form. Write in the month and year for which you are filing.

- Enter your federal employer identification number (FEIN) in the designated field.

- In the 'Name of organization' section, input the name of your corporation, partnership, or organization.

- For the tentative tax due, write the amount you expect to owe based on the calculations from your tax payment worksheet.

- Fill out your organization's street address, city, state, and ZIP code in the appropriate fields.

- Provide a daytime phone number where you can be reached if additional information is needed.

- Review the form for accuracy, making sure all required fields are completed correctly.

- Once all information is entered, save the changes. You may then download, print, or share the completed form as necessary.

Ensure your tax obligations are met by completing the IL505 Form online today.

Illinois tax forms are available online at the Illinois Department of Revenue's website, as well as at various public offices throughout the state. You can also access forms through platforms like UsLegalForms, which makes obtaining the Il505 Form fast and convenient. Utilizing these resources can save you time during tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.