Loading

Get Ar1100ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1100ct online

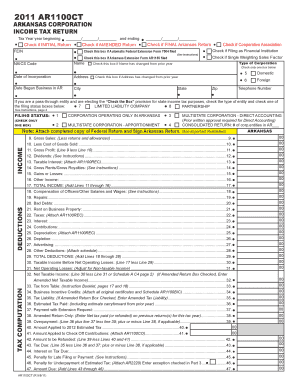

The Ar1100ct is an essential form for Arkansas corporations to report their income and tax liabilities. This guide provides step-by-step instructions for completing the form online, ensuring a smooth filing process for all users, regardless of their prior experience.

Follow the steps to complete your Ar1100ct online.

- Click ‘Get Form’ button to obtain the Ar1100ct and access it in your online editor.

- Begin by entering the tax year for your corporation. This includes indicating the year beginning and ending. Make sure to check the appropriate boxes if this is an amended or initial return.

- Fill in your federal employer identification number (FEIN) and the North American Industry Classification System (NAICS) code.

- Provide your corporation's name, date of incorporation, and business address, including city, state, and zip code. Indicate any changes from the prior year.

- Select the type of corporation you are filing as, and indicate your filing status by checking the appropriate box.

- For the tax computation section, report your gross sales, cost of goods sold, and other relevant income items. Be sure to attach any necessary schedules or forms.

- Complete the deductions section by providing details about expenses such as salaries, taxes, and contributions. Again, ensure attachments are included as specified.

- Transfer the total income and deductions calculations to the appropriate lines and continue to complete the tax liability and payment sections.

- Upon completion, review all entries for accuracy. Users can then save changes, download, print, or share the form as required.

Complete your Ar1100ct online today for a hassle-free tax filing experience.

If you do not file by October 15th, you may incur penalties and interest on any taxes owed. It is advisable to file for an extension if you anticipate needing more time, but be aware that this does not extend the payment deadline. To assist with timely filing or to manage outstanding taxes, Ar1100ct can provide the necessary tools to keep you on track.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.