Loading

Get Missouri 941c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missouri 941c online

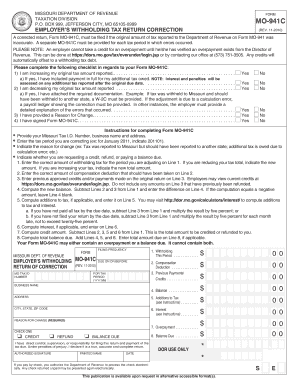

Filling out the Missouri 941c form can be essential for correcting previous withholding tax returns. This guide provides a detailed, step-by-step approach to help users successfully complete the form online.

Follow the steps to accurately complete your Missouri 941c online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your Missouri Tax I.D. Number, along with your business name and address in the designated fields.

- Indicate the tax period you are correcting by entering it in the format YYYYMM (for example, for January 2011, enter 201101).

- Provide a reason for the change made. This could include reasons such as reporting to the wrong state or corrections due to calculation errors.

- Select whether you are requesting a credit, refund, or paying a balance due by checking the appropriate box.

- On Line 1, input the correct amount of withholding tax for the period you are adjusting. If reducing the tax, indicate the new lower amount; if increasing, enter the new total.

- On Line 2, record the correct amount of compensation deduction that should have been taken.

- List any previous approved credits and/or payments made on the original return on Line 3. Ensure you do not include amounts previously refunded.

- Calculate the new balance on Line 4 by subtracting Lines 2 and 3 from Line 1. If this results in a negative amount, leave Line 4 blank.

- If applicable, compute any additions to tax and enter the total on Line 5.

- On Line 6, compute any interest owed, if applicable.

- On Line 7, calculate the total amount to be credited or refunded by subtracting Lines 2, 3, 5, and 6 from Line 1.

- If applicable, compute total balance due by adding Lines 4, 5, and 6, and enter it on Line 8.

- Review the form, ensuring all fields are correctly filled, then sign and date the Form MO-941C.

- After completing the form, you may save changes, download, print, or share the document as needed.

Complete your Missouri 941c form online today for accurate reporting.

Related links form

The deadline to file taxes in Missouri typically coincides with the federal tax deadline, which is often April 15th. However, if this date falls on a weekend or holiday, the deadline may be adjusted. For those who need more time, e-filing an extension can be a viable option. Always stay updated on potential changes or announcements from the Missouri Department of Revenue regarding deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.