Loading

Get Paying A Balance Due (lockbox) For Individualsinternal Revenue...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Paying A Balance Due (Lockbox) For Individuals Internal Revenue online

This guide provides clear, step-by-step instructions for filling out the Paying A Balance Due (Lockbox) for Individuals form online. Ensuring accurate completion is crucial for timely processing of your payment and avoiding delays in applying it to your account.

Follow the steps to complete your payment voucher online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

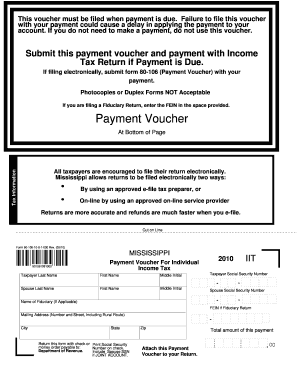

- Begin by entering the taxpayer's last name and first name in the designated fields. If applicable, include the spouse's last name and first name.

- If you are filing a fiduciary return, provide the FEIN in the specified space.

- Input the taxpayer's social security number accurately. Ensure there are no errors to avoid processing delays.

- If filing jointly, enter the spouse’s social security number.

- Complete the mailing address section, including the number and street, city, state, and zip code.

- Indicate the total amount of the payment you are submitting in the space provided, ensuring it reflects the correct total.

- Attach the payment voucher to your income tax return and print the document as necessary.

- Finally, save any changes to your completed form and prepare to submit it, along with payment, according to the filing instructions.

Complete your payment voucher online to ensure efficient processing of your tax payment.

To make an IRS prepayment, you first need to calculate the amount you owe. Then, visit the IRS website or use the IRS payment app to choose your payment method. Options include electronic funds withdrawal or credit/debit card payments. Remember, making timely payments can help you avoid penalties, especially when Paying A Balance Due (Lockbox) For IndividualsInternal Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.