Loading

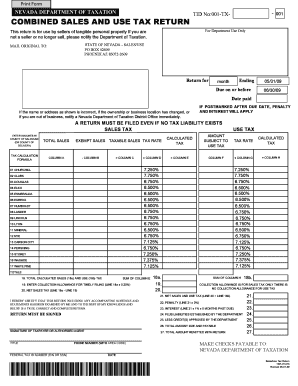

Get Sales & Use Tax Return ( 7-1-06 - 6-30-09)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales & Use Tax Return (7-1-06 - 6-30-09) online

Filing your Sales & Use Tax Return is an essential responsibility for sellers of tangible personal property in Nevada. This guide aims to provide clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to accurately complete your Sales & Use Tax Return online.

- Click ‘Get Form’ button to obtain the form and open it in your digital editor.

- Review the pre-filled fields to ensure your TID number and address are correct. If there are errors, correct them before proceeding.

- For Line 1, enter the total sales amount for your business operations. Ensure this excludes sales tax collected.

- On Line 2, report exempt sales. These are sales not subject to tax, including transactions supported by resale certificates and sales to specific government or charitable entities.

- Calculate taxable sales for Line 3 by subtracting exempt sales (Line 2) from total sales (Line 1).

- Utilize the tax rates provided for each county (from the tax rate chart) to determine your calculated sales tax for Line 4.

- Report the amount subject to use tax on Line 5. This includes any merchandise purchased without Nevada tax and intended for usage rather than resale.

- Calculate the use tax using the applicable tax rate for your county on Line 6.

- Add the calculated sales tax (Line 4) and the calculated use tax (Line 6) for Line 7 to find your total tax liability.

- Complete lines regarding collection allowance, net sales tax, and subsequently total all amounts due on the form.

- Ensure to read and check any additional amounts for penalties and interest on lines 22 and 23 if applicable.

- Certify the return by signing and dating in the designated area, ensuring the information is true and correct.

- Lastly, save your completed form. You will have options to download, print, or share your completed return.

Complete your Sales & Use Tax Return online today for timely filing!

The sales and use tax in Ohio combines a state tax rate of 5.75% with various local taxes, which can elevate the total to around 8%. This tax applies to most retail transactions and is crucial for businesses to understand. Familiarity with this information is vital when completing your Sales & Use Tax Return (7-1-06 - 6-30-09).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.