Loading

Get First B Notice

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the First B Notice online

This guide provides a comprehensive overview of the First B Notice, assisting users in successfully filling out the form online. It offers step-by-step instructions to ensure a seamless and efficient process.

Follow the steps to complete the First B Notice online.

- Click ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Review the form carefully and ensure you have your personal information ready, including your current name and the requested name change.

- Fill in the date of your scheduled hearing and ensure it is accurate.

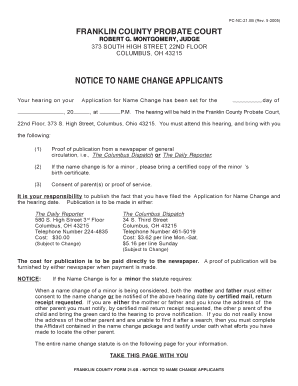

- Indicate the location of the hearing, which is at the Franklin County Probate Court.

- In the appropriate field, provide proof of publication from a newspaper of general circulation.

- If applicable, for name changes concerning a minor, attach a certified copy of the minor’s birth certificate.

- Make sure to include the consent of parents or proof of service if the name change is for a minor.

- Once all details are filled in accurately, review your form for any errors or missing information.

- At the end, save your changes, download, print, or share the form as necessary.

Start completing your First B Notice online today!

An AB notice letter, or Alternative B Notice, serves as a communication tool for the IRS to inform taxpayers about discrepancies in reported information. This type of notice may reference different problems detected in tax filings compared to the records they possess. If you receive such a letter, addressing discrepancies promptly is crucial to avoid penalties. Understanding these notices can help streamline your tax processes and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.