Loading

Get Ohio It 2023 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio IT 2023 Fillable Form online

Filling out the Ohio IT 2023 Fillable Form online is a straightforward process that ensures accurate reporting of your income and related credits. This guide provides step-by-step instructions to help you complete the form effectively.

Follow the steps to complete the Ohio IT 2023 Fillable Form online

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

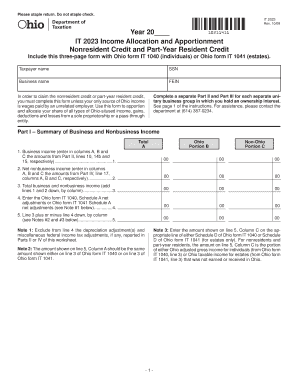

- Begin by entering your taxpayer name and social security number (SSN) at the top of the form. Ensure that all information is accurate to avoid processing delays.

- For those operating a business, provide the business name and federal employer identification number (FEIN). If you have multiple businesses, you will need to complete separate parts for each.

- Move to Part I to summarize your business and nonbusiness income. Input figures for business income in respective columns for Ohio and Non-Ohio portions. The total business income must be accurately calculated and entered.

- Proceed to Parts II and III to list detailed business income, deductions, and apportionment formulas. Include accurate breakdowns as directed in each section.

- In Part IV, declare any nonbusiness income and associated deductions. Be mindful to differentiate between business and nonbusiness items as specified.

- Review all entries carefully to ensure accuracy and completeness. Making corrections before submitting will save time later.

- Once all sections are completed, you can save changes, download, print, or share the form as needed. Always keep a copy for your records.

Ensure you file your forms online promptly for a smoother experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can choose to file only your state tax return in Ohio if you meet the filing requirements. It's crucial to ensure that your Ohio IT 2023 Fillable Form is complete and accurate. If you previously filed federal taxes, remember to keep that information handy, as it may assist you with your state filing. US Legal Forms is a helpful resource for accessing the necessary forms and guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.