Loading

Get Ftb35402009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb35402009 Form online

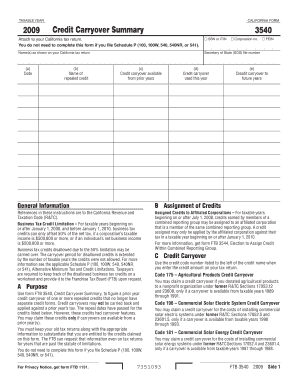

Filling out the Ftb35402009 Form online is a straightforward process that allows users to manage their credit carryovers efficiently. This guide provides clear, step-by-step instructions to assist users in completing the form accurately.

Follow the steps to fill out the Ftb35402009 Form online:

- Press the ‘Get Form’ button to access the Ftb35402009 Form and open it in your chosen editor.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated field.

- Fill in the names as they appear on your California tax return; ensure accurate spelling and format.

- If applicable, provide your Secretary of State (SOS) file number in the specified section.

- In column (a), input the code numbers for the carryover credits you qualify for from the relevant instructions.

- In column (b), write the name of the repealed credit corresponding to each code number.

- In column (c), enter the amount of credit carryover from prior years, which should be on your previous year's tax return or related schedule.

- Record the amount of credit carryover you are claiming on your current tax return in column (d). Refer to credit limitations to determine this amount.

- Subtract the amount in column (d) from column (c) to find the future carryover amount; enter this result in column (e).

- Review all entries for accuracy and ensure that all required fields are completed before proceeding.

- Once finished, save your changes, and proceed to download, print, or share the form as needed.

Start filling out your Ftb35402009 Form online today!

Waiving your FTB penalty often involves submitting a request through the proper channels, and using the Ftb35402009 Form can facilitate this process. Ensure you provide a valid reason and any supporting documents to strengthen your case. Additionally, consult the California Franchise Tax Board for guidance on your specific situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.