Loading

Get 2004 Guidelines For Filing A Group Form 540nr - California ... - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 Guidelines for Filing a Group Form 540NR - California online

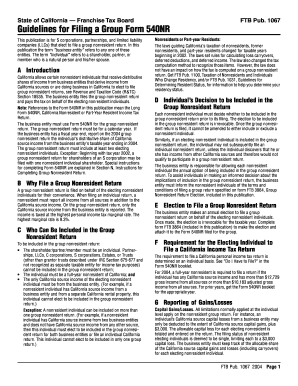

This guide serves as a comprehensive resource for users looking to fill out the 2004 Guidelines for Filing a Group Form 540NR in California. It outlines the necessary steps and provides clear instructions to facilitate a smooth filing experience online.

Follow the steps to fill out the Group Form 540NR seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin filling out the form by entering the name and address of the business entity as shown on the provided materials. If using a mailing label, affix it to the front of Form 540NR.

- Complete Schedule 1067A, Nonresident Group Return Schedule, with details of electing individuals. Ensure to input the distributive shares of California source income accurately for each individual.

- In Section A, determine the filing status and proceed to Steps 1, 1a, and 2. Make sure to denote 'Group Nonresident Return' next to your selected filing status.

- Calculate the total California tax based on column (e) in Schedule 1067A and enter it on the appropriate line of the 540NR form.

- If any amount is due, prepare a check or money order payable to 'Franchise Tax Board', including the business entity’s FEIN and other designated details.

- Complete and sign Form FTB 3864, ensuring it is signed by an authorized representative of the business entity.

- Double-check all entries for accuracy and completeness before submitting the form. Save your changes, download it, print it, or share the completed form as necessary.

Start filling out your Group Form 540NR online today for efficient tax management.

Non-U.S. residents who earn income in the United States need to file Form 1040NR. This includes those who wish to report their tax obligations while ensuring compliance with the 2004 Guidelines For Filing A Group Form 540NR - California ... - Ftb Ca. Seeking assistance from resources like uslegalforms can make the process smoother for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.