Loading

Get 2019 Form 3539

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Form 3539 online

Filling out the 2019 Form 3539 online can be a seamless process with the right guidance. This comprehensive guide will assist you in navigating through each section and field of the form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the form and open it in your browser.

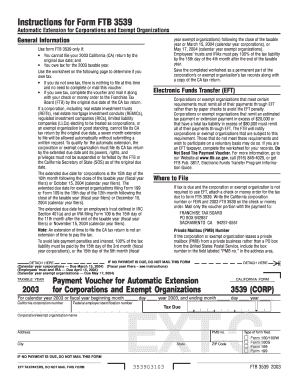

- Identify the taxable year for which you are filing the form. Enter '2019' in the appropriate field.

- Fill in your California corporation number and federal employer identification number (FEIN) as required.

- Enter the name of your corporation or exempt organization in the designated field.

- Provide your address including city, state, and ZIP Code to ensure proper identification of your organization.

- Review the tax payment worksheet to determine if you owe tax for the 2019 taxable year.

- Input the total tentative tax, including any applicable alternative minimum tax, on line 1 of the worksheet.

- Enter any estimated tax payments made, including any prior year overpayments applied as a credit, on line 2.

- Calculate the tax due by subtracting the amount on line 2 from line 1 and place the result on line 3.

- If any payment is due, attach a check or money order to the completed voucher and ensure to mail it to the Franchise Tax Board as instructed.

- Finally, save your completed form for your records. You can download, print, or share the form as needed.

Complete your documents online to ensure timely submission.

Yes, you can make estimated tax payments electronically through the IRS website. This option is convenient, especially when managing your tax obligations associated with the 2019 Form 3539. Utilizing electronic payments not only saves time but also helps ensure your payments are processed promptly, reducing the risk of late penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.