Get 100s Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 100s Form online

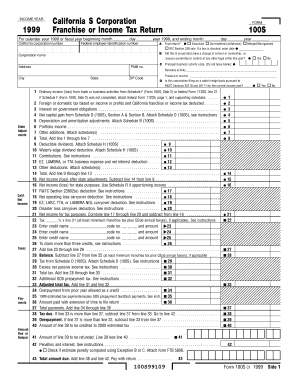

Filling out the 100s Form online can streamline the process of filing your California S Corporation Franchise or Income Tax Return. This guide aims to provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the 100s Form online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter the income year at the top of the form and specify whether it is for a calendar year or a fiscal year by completing the relevant fields.

- Fill in the California corporation number and federal employer identification number accurately in their respective fields.

- Enter the corporation name in the designated space and indicate if this is a final return by checking the appropriate box.

- Complete the address section, ensuring all fields including the city, state, and ZIP code are filled out correctly.

- Provide the principal business activity code and briefly describe the business activity in the designated space.

- Indicate whether the corporation is filing on a water's-edge basis by selecting 'Yes' or 'No' in the appropriate section.

- Carefully complete the income and tax calculation sections, ensuring that totals are accurately calculated from the provided schedules.

- Once all fields are completed and reviewed for accuracy, you can choose to save changes, download, print, or share the form as needed.

Start filling out your 100s Form online now for a smooth filing experience.

The SA100 tax form is essential for individuals in the UK to report their income, allowing them to calculate their tax liability. This self-assessment form is suitable for anyone with income that isn't taxed at source, such as rental income or self-employment earnings. To simplify your filing process, explore the US Legal Forms platform for tools and resources that help you manage your tax paperwork efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.