Loading

Get R 30 Cde Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 30 Cde Form online

Filling out the R 30 Cde Form online can seem daunting, but with the right guidance, you can complete it efficiently and accurately. This comprehensive guide will provide a step-by-step approach to help you navigate each section of the form with confidence.

Follow the steps to complete the R 30 Cde Form effectively.

- Click ‘Get Form’ button to obtain the R 30 Cde Form and open it in your preferred editor.

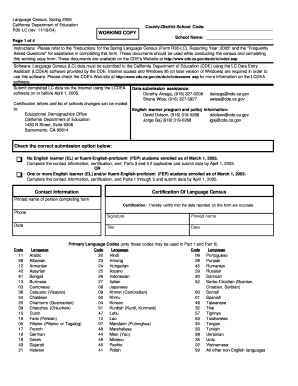

- Begin by entering the County-District-School Code in the designated field at the top of the form.

- Input the School Name accurately to ensure proper identification.

- Refer to the instructions provided for guidance on how to complete the contact information sections. Fill in the relevant details such as printed name, phone number, and date.

- In the Certification section, confirm the accuracy of the data reported on the form by signing and dating appropriately.

- Move to Part 1, where you will report all English learner (EL) and fluent-English-proficient (FEP) students enrolled as of March 1, 2005. Ensure that you list each language code only once.

- Complete Part 2 by detailing the number of English learners enrolled in specific instructional settings. Make sure that totals match those reported in Part 1.

- In Part 3, enter the total number of English learners redesignated as fluent-English-proficient students since the last census.

- Fill out Part 4 regarding parental waivers of English language classrooms, indicating the number granted and denied.

- In Part 5, report the number of teachers and bilingual paraprofessionals providing services to English learners, ensuring accuracy in the count.

- Once all sections are completed, review the information for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your R 30 Cde Form online today for efficient submission.

To claim a solar credit, you will primarily use Form 5695. This form allows you to complete the R 30 Cde Form necessary for applying for tax credits related to solar energy installations. It is designed to simplify the process and ensure that taxpayers can easily capture their benefits from solar investment. By using this form, you can maximize your savings while also promoting renewable energy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.