Get Dco 712 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dco 712 Form online

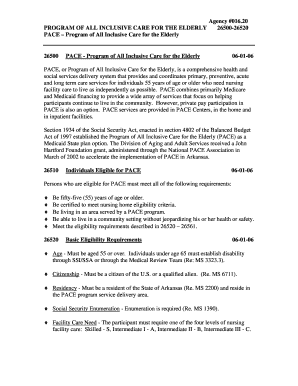

Filling out the Dco 712 Form online is a straightforward process designed to help users apply for the Program of All Inclusive Care for the Elderly (PACE). This guide will walk you through each section of the form clearly and supportively, ensuring you have the information needed to complete it correctly.

Follow the steps to fill out the Dco 712 Form online effectively.

- Click the ‘Get Form’ button to access the Dco 712 Form. This will allow you to open the form in an online editor.

- Begin by entering your personal information in the designated fields, including your name, date of birth, and contact details. Ensure all details are accurate, as this information will be used to assess your eligibility.

- Next, provide the required eligibility information, confirming that you meet the minimum age requirement of 55 years and detailing whether you reside in the PACE service area.

- Fill out the medical necessity section by indicating any medical conditions that may qualify you for PACE services. Be sure to provide specifics to assist in the evaluation process.

- Submit your income and resource details, ensuring you do not exceed the allowable limits for PACE eligibility. If needed, include information regarding any income trusts established to meet eligibility.

- Review the completed form carefully, checking for any missing information or errors. Making certain that all details are correct will help expedite your application process.

- Once you have verified the information, proceed to save the changes to the document. You may then download, print, or share the form as required.

Complete your Dco 712 Form online today and take the first step towards accessing vital services through the PACE program.

The DCO 153 consent is a form that grants permission for a designated representative to act on behalf of an estate. This consent is essential when a representative needs to communicate with the IRS regarding the estate and its associated taxes. Filing the DCO 712 Form alongside the DCO 153 consent streamlines the process, facilitating clearer communication and quicker resolutions for estate matters.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.