Loading

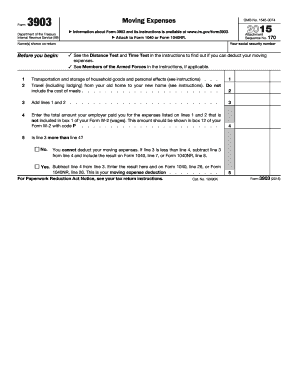

Get 2015 Form 3903. Moving Expenses - Irs Ustreas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form 3903. Moving Expenses - Irs Ustreas online

Filling out Form 3903 is essential for individuals who are seeking to deduct moving expenses related to a change in their principal place of work. This guide provides clear and detailed instructions to help users complete the form accurately and efficiently.

Follow the steps to complete Form 3903 accurately.

- Click ‘Get Form’ button to obtain the form and open it in an editor.

- Enter your social security number in the appropriate field at the top of the form.

- Provide your name(s) as shown on your return below the social security number. Ensure that it matches the information on your tax return.

- In Section 1, itemize your transportation and storage expenses by entering amounts for packing, crating, and moving your household goods in line 1.

- For line 2, enter the total amount paid for travel from your old home to your new home, including transportation and lodging. Remember, meals should not be included.

- Add the amounts from lines 1 and 2 and enter the result on line 3.

- On line 4, input any reimbursement received from your employer for the expenses listed on lines 1 and 2. This amount should come from box 12 of your Form W-2 with code P.

- Determine if line 3 is greater than line 4. If it is not, you cannot deduct your moving expenses. If it is, subtract line 4 from line 3 and enter the result on line 5, which is your moving expense deduction.

- Attach Form 3903 to Form 1040 or Form 1040NR when filing your tax return.

- Once completed, save your changes and download, print, or share the form as needed.

Start filling out your Form 3903 online today to take advantage of your moving expense deductions!

Shipping and storage costs for packing and moving your household goods and personal effects go on line 1 of Form 3903. Travel, lodging, and gas costs go on line 2. Reimbursements from your employer for any moving expenses are reported on line 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.