Loading

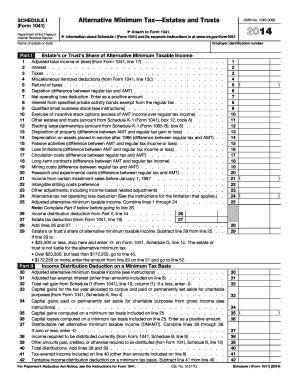

Get 2014 Schedule I (form 1041). Alternative Minimum Tax Estates And Trusts - Irs Ustreas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Schedule I (Form 1041). Alternative Minimum Tax Estates And Trusts - IRS USTreas online

This guide provides step-by-step instructions on how to effectively complete the 2014 Schedule I (Form 1041) for Alternative Minimum Tax for estates and trusts. Designed for a broad audience, this comprehensive resource will help users navigate the form with confidence.

Follow the steps to accurately complete the Schedule I form.

- Press the ‘Get Form’ button to access the Schedule I (Form 1041) document online.

- Begin by entering the estate’s or trust’s name and employer identification number at the top of the form. Make sure the information matches the documentation provided to the IRS.

- Continue to Part I where you will calculate the estate’s or trust’s share of alternative minimum taxable income. Fill in each line with the appropriate values, ensuring that you refer to the instructions provided by the IRS for guidance.

- Provide details for adjusted alternative minimum taxable income in the respective fields. Be diligent in reviewing each line for accuracy.

- In Part II, calculate the income distribution deduction on a minimum tax basis by first subtracting the indicated lines to find the tentative income distribution deduction.

- Continue to Part III to find the alternative minimum tax calculation. Follow the specific steps laid out, making note of exemption amounts and income requirements.

- If applicable, complete Part IV, which includes computations using maximum capital gains rates. It’s important to handle this section with care to ensure compliance with tax regulations.

- Review all entries for accuracy before saving your changes. Ensure you have completed all required fields as inaccuracies could lead to delays or issues with processing.

- Once you have completed the form, you can save your changes, download, print, or share the Schedule I (Form 1041) online, ensuring you keep a copy for your records.

Take the next step in your document management by efficiently completing and filing your forms online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.