Get Form Rd 4279 1a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RD 4279 1a online

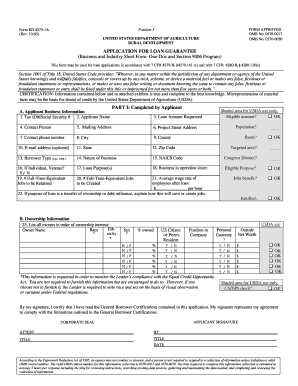

Filling out the Form RD 4279 1a is an essential step for those seeking loan guarantees from the United States Department of Agriculture. This guide will provide you with clear directions on how to complete the form efficiently and accurately.

Follow the steps to fill out the Form RD 4279 1a online.

- Click ‘Get Form’ button to download the form and open it in the provided online editor.

- Begin with Part I, where you will input your business information. This includes your Tax ID number or Social Security number, applicant name, loan amount requested, and contact details such as the mailing and project addresses.

- Provide information about the purpose of the loan in the designated fields. Describe how the funds will be utilized and how they may contribute to job creation or retention.

- In the Ownership Information section, list all owners along with their ownership interest. Ensure to include the ethnicity and gender details where relevant.

- Continue to fill out the Lender Information section, which should be completed by the lender after the borrower provides their information. This includes lender's name, tax ID, contact details, and specific loan information.

- Complete the Loan Information portion by inputting details about the loan amount, interest rates, and terms.

- In the Attachments section, include any necessary documentation that supports your application, like financial statements and environmental compliance requests.

- Once all sections are filled out accurately, review the form for any errors or missing information.

- Finally, save your changes. You may download a copy, print it, or share it, as required.

Start your application process and complete the Form RD 4279 1a online today.

SBA loans are not 100% guaranteed, but they do offer strong backing, which can significantly reduce risk for lenders. With the support of programs such as Form Rd 4279 1a, these loans often come with favorable terms and lower down payment requirements. While these loans provide a safety net, certain conditions still apply, and you should explore your options thoroughly. Understanding these details can help you make informed financial decisions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.