Get Monthly Report Of Storage Operations - Ttb.gov - Ttb Treas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MONTHLY REPORT OF STORAGE OPERATIONS - TTB.gov - Ttb Treas online

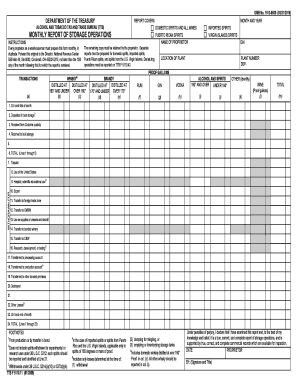

The MONTHLY REPORT OF STORAGE OPERATIONS is a crucial document required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for warehouse proprietors. This guide provides clear instructions on how to accurately complete this form online, ensuring compliance and proper record keeping.

Follow the steps to complete the monthly report accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in the reporting month and year at the top of the form. Ensure that this reflects the correct period for which you are reporting.

- Complete the section labeled 'NAME OF PROPRIETOR' by entering the name of the warehouse proprietor, and provide the Employer Identification Number (EIN) in the designated field.

- Enter the 'LOCATION OF PLANT' which indicates where your operations are based.

- In the 'TRANSACTIONS' section, begin reporting for domestic spirits and wines, imported spirits, Puerto Rican spirits, and spirits from the U.S. Virgin Islands as required in their respective categories.

- For each applicable category (e.g., whisky, rum, gin, vodka), enter the proof gallons for the entries for months beginning, deposits, and receipts.

- Accurately fill out the withdrawal categories where applicable, including taxpaid spirits, educational, and hospital uses, as well as other potential transactions.

- Complete all totals as directed, ensuring that lines 1 through 23 are added up correctly and that the final totals match the calculations.

- Review the declaration statement at the bottom of the form, sign, and date it to confirm the information provided is accurate and complete.

- Once the form is complete, save your changes, and utilize options for downloading or printing the report as necessary. Ensure you keep a copy for your records.

Take the next step in your compliance journey by completing your monthly report online today.

No, the Alcohol and Tobacco Tax and Trade Bureau (TTB) and the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) serve different functions. The TTB focuses on regulating and collecting taxes for alcohol and tobacco, while the ATF handles firearms and explosives. If you're preparing the MONTHLY REPORT OF STORAGE OPERATIONS - TTB - Ttb Treas, you will need to work specifically with the TTB for your reporting requirements. Understanding these distinctions can help streamline your compliance with federal regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.