Loading

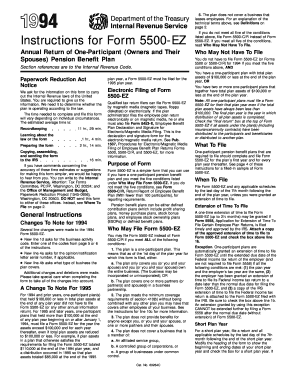

Get 1994 Inst 5500ez - Internal Revenue Service - Irs Treas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1994 Inst 5500EZ - Internal Revenue Service - Irs Treas online

Filling out the 1994 Inst 5500EZ is an essential process for individuals managing a one-participant pension benefit plan. This guide provides clear, step-by-step instructions on each section of the form to help you complete it accurately online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- At the top of the form, indicate if this is the first return filed, an amended return, a final return, or if it pertains to a short plan year by checking the appropriate box.

- In line 1a, enter the name of the employer. It is advisable to use the IRS label if available.

- Complete line 1b by entering the employer identification number (EIN) in the format '00-1234567'.

- In line 1d, enter the business activity code from the provided list that best describes the nature of the employer's business.

- For line 2, indicate whether the employer is also the plan administrator by checking 'Yes' or 'No'. If 'No,' provide the plan administrator's name and EIN.

- On line 2b, enter the name of the plan, which should not exceed 70 characters, and record the date the plan first became effective on line 2c.

- Complete line 2d by assigning a three-digit plan number to the pension plan starting from 001.

- In line 3, specify the type of plan by checking one box that corresponds to the plan type.

- Proceed to complete the financial sections, including contributions and distributions, on lines 7 through 10 as applicable.

- If necessary, attach required schedules such as Schedule B for defined benefit plans.

- Ensure to sign and date the form at the end, as required by the plan administrator or employer.

- Finally, after completing the form, save your changes, download a copy for your records, and submit it to the IRS according to the instructions provided.

Complete your 1994 Inst 5500EZ form online today to ensure compliance and avoid penalties.

The 5500-EZ must be filed annually by the last day of the seventh month after the plan year ends. Failing to file can lead to hefty penalties, which makes timely submission crucial. To stay on track, use tools like uslegalforms to set reminders and access necessary forms, alongside the guidance found in the 1994 Inst 5500EZ - Internal Revenue Service - Irs Treas.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.