Loading

Get - Irs Treas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

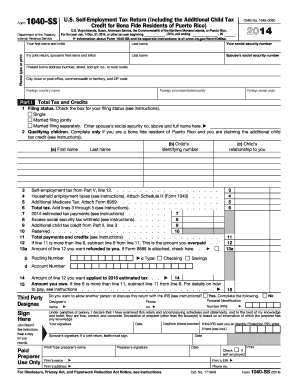

How to fill out the IRS Treas 1040-SS online

This guide provides a detailed overview of how to complete the IRS Treas 1040-SS online. It is designed to support users of all experience levels in accurately filling out this self-employment tax return form.

Follow the steps to successfully complete IRS Treas 1040-SS online.

- Click ‘Get Form’ button to obtain the IRS Treas 1040-SS form and open it in your document editor.

- Begin by entering your personal information, including your first name, last name, and social security number. If filing jointly, include your spouse’s details.

- Provide your present home address, including city, state, and ZIP code, along with any foreign address if applicable.

- In Part I, select your filing status by checking the relevant box (single, married filing jointly, or married filing separately) and complete the section for qualifying children only if you are a bona fide resident of Puerto Rico.

- Fill out the total tax and credits section, ensuring to calculate all applicable taxes including self-employment tax, household employment taxes, and additional Medicare tax.

- If you have overpaid taxes, specify the amount you wish to be refunded or applied to your estimated tax for the following year.

- Proceed to Part II if you are claiming the additional child tax credit, providing income details and applicable withheld taxes.

- For farm income, fill out Part III by detailing your income and expenses related to farming, whether under cash or accrual methods.

- Complete Part IV for any business losses or profits, detailing your income and expenses from the sole proprietorship.

- Finally, complete Part V to calculate your self-employment tax. Ensure to follow the instructions for each line to accurately report your earnings.

- Review all entries for accuracy, then save your changes or download your completed form for your records.

- You can then print the form or share it with relevant parties as needed.

Start completing your IRS Treas 1040-SS online today to ensure timely filing and compliance.

Filling out a federal tax withholding form involves understanding your financial situation and tax obligations. Begin by gathering information about your income, deductions, and family status. Utilizing platforms like USLegalForms simplifies the process, providing you step-by-step guidance to complete the form accurately and ensure proper withholding throughout the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.