Get Nj-1040-tr Instructions - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ-1040-TR Instructions - State Of New Jersey - State Nj online

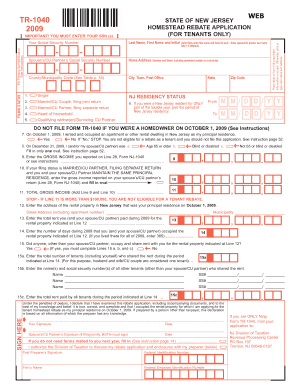

This guide provides a comprehensive overview of the NJ-1040-TR Instructions for users filing in New Jersey. It will assist you in navigating each section of the form, ensuring accurate completion to facilitate your homestead rebate application.

Follow the steps to fill out the NJ-1040-TR form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling out your personal information. Enter your Social Security Number, last name, first name, and initial. If filing jointly, include your spouse’s or civil union partner’s details accordingly.

- Indicate your home address, including the county and municipality code. You can refer to the tables provided in the instructions for accurate coding.

- Select your filing status by marking the appropriate oval for options such as single, married filing jointly, married filing separately, or head of household.

- If applicable, specify your residency status in New Jersey, indicating the duration of your residency, especially if it was only for part of the taxable year.

- Confirm that you rented and occupied the property as your primary residence on October 1, 2009. A 'Yes' response is needed to proceed.

- Complete the income sections. Enter your gross income and, if filing separately, your spouse’s or civil union partner’s gross income on the designated lines.

- Provide the address of the rental property and details of the rent you and your spouse/civil union partner paid during the year.

- If applicable, provide information regarding any shared tenants and their respective details, if you shared the rent.

- Sign and date the application. Both partners must sign if applicable. Ensure that the signatures are handwritten and not photocopied.

- Finalize your application by sending it to the appropriate address, as mentioned in the instructions, ensuring it is sent before any deadlines.

- Remember to save changes, download, print, or share the completed form as needed.

Complete your tenant rebate application online to take advantage of available benefits.

The destination for your 1040 forms depends on whether you are filing a federal or state return. For federal 1040 forms, you would send them to the IRS address designated for your state. For state forms, including the NJ-1040, refer to the NJ-1040-TR Instructions - State Of New Jersey - State Nj for precise mailing details. For further support in ensuring your forms are sent correctly, uslegalforms provides a wealth of knowledge and assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.