Loading

Get Nj 1080e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj 1080e online

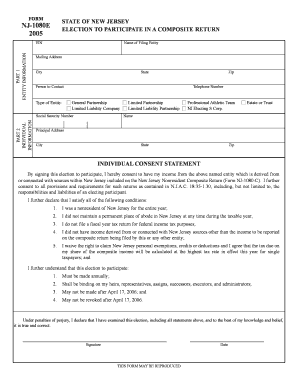

The Nj 1080e form is an important document for individuals looking to participate in a composite return for New Jersey gross income tax purposes. This guide provides clear and supportive instructions to help users fill out the form online efficiently and accurately.

Follow the steps to complete the Nj 1080e form online.

- Press the ‘Get Form’ button to obtain the Nj 1080e and open it for editing.

- In Part 1, fill in the entity information, including the Employer Identification Number (EIN), name of the filing entity, mailing address, city, state, zip code, contact person's name, type of entity, and their telephone number.

- In Part 2, enter individual information by providing the name and principal address of the individual, including city, state, and zip code.

- Carefully read and acknowledge the individual consent statement. Ensure that the individual meets all conditions outlined, such as being a nonresident for the entire year and not claiming personal exemptions.

- Sign and date the form where specified to certify that all information provided is accurate.

- Once all sections are completed, you can save the changes, download, print, or share the Nj 1080e as needed.

Complete your documents online to ensure compliance and smooth processing.

1, 2019 and filed or were exempt from state income taxes. Homeowners who made up to $150,000 then are eligible to receive a $1,500 rebate on their property tax bills, and those who made $150,000 to $250,000 are eligible to receive a $1,000 rebate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.