Loading

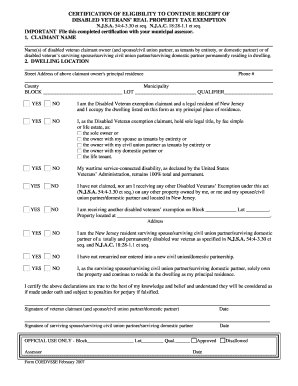

Get Certification Of Eligibility To Continue Receipt Of Disabled Veterans' Real Property Tax Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certification Of Eligibility To Continue Receipt Of Disabled Veterans' Real Property Tax Exemption online

The Certification Of Eligibility To Continue Receipt Of Disabled Veterans' Real Property Tax Exemption form is important for disabled veterans to maintain their property tax exemptions. This guide provides a clear, step-by-step approach to completing the form online, ensuring a smooth filing process.

Follow the steps to complete your certification form online.

- Press the ‘Get Form’ button to access the certification form in your preferred editor.

- Begin by filling out the Claimant Name section. Enter the name of the disabled veteran who is the claimant owner and, if applicable, their spouse or partner's name.

- In the Dwelling Location section, provide the street address for the principal residence of the claimant. Ensure that the address is complete and accurate.

- Enter the phone number of the claimant to facilitate communication regarding the exemption.

- For the County and Municipality fields, select your location from the provided options to identify your local area.

- Fill in the Block, Lot, and Qualifier numbers as designated by your local tax office.

- Respond to the set of eligibility questions with 'Yes' or 'No' based on your status as a disabled veteran and the specifics of your residency and ownership.

- Read and understand the certification statement regarding the truthfulness of the information provided. Your signature, alongside the date, will be required in this section.

- Finally, review the completed form for accuracy. Once you are satisfied, save your changes, and utilize the options to download or print the document for submission.

Complete your Certification Of Eligibility To Continue Receipt Of Disabled Veterans' Real Property Tax Exemption online today.

California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a qualifying deceased disabled veteran. Who may qualify? US military veterans rated 100% disabled or 100% unemployable due to service connected injury or disease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.