Get Cbt-100a - Instructions - 1999 - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CBT-100A - Instructions - 1999 - State Of New Jersey online

Filling out the CBT-100A form for the State of New Jersey requires attention to detail and an understanding of the necessary fields. This guide will walk you through each step to ensure your form is completed correctly and submitted on time.

Follow the steps to complete your CBT-100A form efficiently.

- Click ‘Get Form’ button to obtain the CBT-100A form and open it in your preferred online platform.

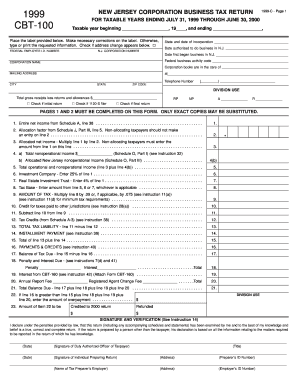

- Complete the taxpayer information section at the top of the form, including your Federal Employer Identification Number and New Jersey Corporation Number. If no pre-printed label is available, type or print your corporation's information directly in the provided spaces.

- Fill in the accounting period for the corporation, ensuring that the dates are correct and match the reporting period for tax purposes. This period starts on the first day of the month and ends on the last day.

- Indicate whether the return is your first or final return, if applicable. Check the corresponding boxes as needed to inform the tax authority of your filing status.

- Record your total gross receipts, less returns and allowances, based on your financial records. Enter this value in the designated space on the form.

- Complete Schedule A, where you will calculate your entire net income. Be meticulous to ensure that all figures align with your Federal Income Tax Return.

- Proceed to fill in all required schedules applicable to your form. Ensure each schedule has been completed thoroughly, including all necessary computations and supplemental information.

- Review your entries for accuracy. Double-check that all figures correspond with related schedules and that you have not left any queries unanswered.

- Once all sections and schedules are completed, save your form. You can download a copy for your records and prepare it for submission.

- Submit the form following the specific instructions for mailing or electronic submission, ensuring you include any required payment with your application.

Complete your CBT-100A form online today to ensure compliance with New Jersey tax regulations.

NJ Taxation The Corporation Business Tax rate is 9% on adjusted entire net income or on the portion allocable to New Jersey.

Fill CBT-100A - Instructions - 1999 - State Of New Jersey - State Nj

(a) 1999 ACCOUNTING PERIODS AND DUE DATES: The. (d) Send the completed return to: State of New Jersey, Division of. Taxation, Corporation Tax, PO Box 666, Trenton, NJ 08646-0666. , and must continue to file the New Jersey Corporation Business Tax Return, Form CBT-100. This section of the specifications seeks to help vendors correctly implement this technology on the New Jersey CBT100 and CBT100S tax returns. Beginning with the 1999 tax year, the State of New Jersey integrated the annual report and corporation business tax systems. The NJ CBT 100 refers to the Computer-Based Testing (CBT) format used for the Commercial. Driver License knowledge tests in New Jersey. The form for NJ is CBT 100S. Beginning with the 1999 tax year, the State of New Jersey integrated the annual report and corporation business tax systems.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.