Loading

Get Form 723 Pbgc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 723 Pbgc online

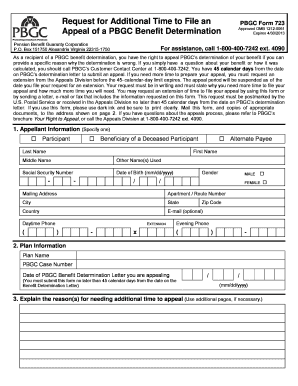

This guide is designed to assist you in completing the Form 723 Pbgc online, allowing you to request additional time to file an appeal of your PBGC benefit determination. By following these steps, you will provide the necessary information clearly and accurately.

Follow the steps to complete Form 723 Pbgc online

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter your appellant information. Specify if you are a participant, beneficiary of a deceased participant, or alternate payee. Fill out the fields with your last name, first name, middle name, and any other names used. Provide your social security number, date of birth, and gender. Include your mailing address along with apartment/route number, city, state, country, email (optional), daytime phone number (with extension), and evening phone number.

- Provide the plan information. Enter the plan name, PBGC case number, and the date of the PBGC benefit determination letter you are appealing. Ensure this form is submitted within 45 calendar days from this date.

- Explain the reason(s) for needing additional time to appeal. If necessary, use additional pages to ensure clarity.

- Indicate how much additional time you require to file your appeal by selecting from the options of 30 days, 45 days, or specifying a different number of days.

- If applicable, provide the authorized representative information. Select whether the representative is an attorney or another person, and fill in their relevant contact information.

- Sign and date the request. Ensure that you understand that providing false information is a crime. Declare that all information given is true and correct to the best of your knowledge.

- Once completed, you can save the changes, download, print, or share the form as needed. You may submit it by mail or fax to the Appeals Division at the address or numbers indicated.

Take the next step in your appeal process by completing Form 723 Pbgc online today.

To apply for PBGC benefits, you should start by filling out Form 723 Pbgc. This form requires you to provide personal information and details about your pension plan. Once you’ve completed and submitted the form, PBGC will review it, which usually takes around 90 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.