Get Form Ccc 931c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ccc 931c online

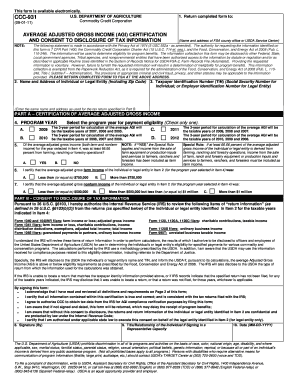

Completing the Form Ccc 931c online can seem daunting, but this guide provides clear, step-by-step instructions to help users navigate the process with ease. The form is essential for certifying average adjusted gross income and consent to disclosure of tax information for eligibility in various programs administered by the U.S. Department of Agriculture.

Follow the steps to complete the Form Ccc 931c online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the individual or legal entity in the designated field, ensuring it matches the details on the tax return specified.

- Provide the taxpayer identification number (TIN) in the format provided, indicating either the Social Security Number or Employer Identification Number.

- Select the program year for which benefits are being requested by checking the appropriate box.

- Indicate whether at least 66.66 percent of the average adjusted gross income is derived from farming, ranching, or forestry operations by selecting either 'YES' or 'NO'.

- Choose the appropriate box that describes the average adjusted gross farm income for the specified 3-year period.

- Select the option that best describes the average adjusted gross nonfarm income for the specified 3-year period.

- Sign the form, acknowledging that you have reviewed all definitions and requirements.

- Fill in your title or relationship to the legal entity if signing on their behalf.

- Record the date in month, day, and year format in the provided field. Ensure the form is submitted to FSA within 120 days of this date.

Complete your forms online today to ensure timely processing of your applications!

Yes, the $900,000 AGI limit does apply even if a farmer earns 75% of their income from farming. This threshold is set by the USDA to determine eligibility for certain programs. If you operate under guidelines related to Form Ccc 931c, understanding these income thresholds can help you access the necessary resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.