Get Federal Direct Consolidation Loan Application And Promissory Note 11302010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Federal Direct Consolidation Loan Application and Promissory Note 11302010 form online

Filling out the Federal Direct Consolidation Loan Application and Promissory Note 11302010 form online can seem daunting. However, this guide is designed to provide you with easy-to-follow instructions, ensuring a smooth completion process as you consolidate your federal education loans.

Follow the steps to complete your loan application online.

- Click the ‘Get Form’ button to access the Federal Direct Consolidation Loan Application and Promissory Note 11302010 form and open it for editing.

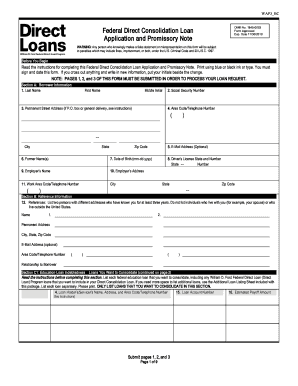

- Begin by filling out Section A: Borrower Information. Input your last name, first name, and middle initial. Include your Social Security Number, area code and telephone number, and permanent street address. If applicable, provide your email address and driver’s license information.

- In Section B: Reference Information, list two persons who have known you for at least three years and have different addresses. Avoid listing individuals who live with you.

- Proceed to Section C1: Education Loan Indebtedness – Loans You Want to Consolidate. Here, accurately list each federal education loan that you wish to consolidate. Include the loan type, holder’s or servicer's name, address, account number, and estimated payoff amount. If needed, utilize the additional loan listing sheet provided.

- In Section C2: Education Loan Indebtedness – Loans You Do Not Want to Consolidate, list all education loans that you do not want to consolidate, similar to the process in Section C1.

- Next, navigate to Section D: Repayment Plan Selection. Review your options carefully, and select the repayment plan that best suits your financial situation. If choosing the Income Contingent Repayment Plan, complete the corresponding form provided.

- In Section E: Borrower Understandings, Certifications, and Authorizations, carefully read each statement and check the boxes to certify your understanding and agreement.

- In Section F: Promissory Note, read through the terms carefully. Your signature will indicate your agreement to repay the loans as outlined. Be sure to include the date of signing.

- Finally, after ensuring all sections are filled out accurately, save your changes. You may download, print, or share the completed form as necessary.

Complete the Federal Direct Consolidation Loan Application and Promissory Note 11302010 form online today to streamline your loan management.

Yes, a direct consolidation loan is a federal loan designed to simplify repayment for borrowers with multiple federal loans. By consolidating, you combine these loans into one with a fixed interest rate. This can ease the burden of managing multiple payments. If you're considering a Federal Direct Consolidation Loan Application And Promissory Note 11302010 Form, you are dealing with a federal loan product.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.