Get 1 Does The Credit Union Maintain A List Of The Third Party Companyies Or Firms Which They Use For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Does The Credit Union Maintain A List Of The Third Party Companies Or Firms Which They Use For online

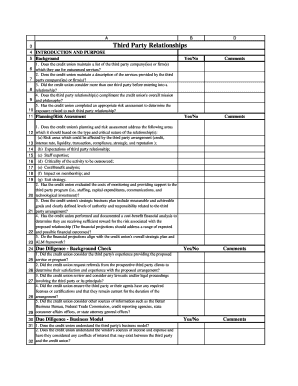

This guide aims to assist credit union users in effectively completing the form concerning third-party relationships. Understanding the requirements and expectations outlined in this document is essential for ensuring compliance and maintaining strong management of outsourced services.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the document and open it immediately for editing.

- Begin by answering the first question about whether the credit union maintains a list of third-party companies used for outsourced services. Mark 'Yes' or 'No', and provide comments if necessary.

- Proceed to the next queries regarding other aspects of third-party relationships, such as the description of services provided and consideration of multiple third parties before entering agreements.

- Evaluate if these relationships complement the credit union's mission and philosophy, and provide a risk assessment for each third-party relationship.

- Continue filling out sections covering planning and risk assessment, due diligence checks, and financial considerations, ensuring to provide clear comments or justifications as needed.

- Review all answers for accuracy, ensuring alignment with internal policies and regulatory requirements, then proceed to save your changes, download, print, or share the form as necessary.

Complete your documentation online and maintain comprehensive oversight of third-party relationships.

In banking, a third party refers to any individual or organization that is not directly involved in a transaction. This can include service providers, vendors, or partners that facilitate various banking services. Many institutions, including credit unions, often work with third party companies to enhance their offerings. Knowing who these parties are can help you understand the services provided by your credit union.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.