Get Instructions For Ncua 6309: Within 30 Days After The Effective Date Of ... - Ncua

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For NCUA 6309: Within 30 Days After The Effective Date Of ... - Ncua online

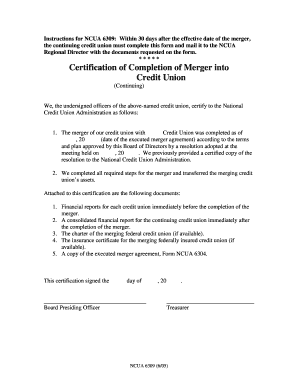

This guide provides a clear, step-by-step approach to completing the Instructions for NCUA 6309, ensuring you submit the required documentation for your credit union’s merger promptly and accurately. By following this guidance, you can navigate the online process with confidence.

Follow the steps to complete the NCUA 6309 form online.

- Press the ‘Get Form’ button to access the form, enabling you to begin the completion process.

- Fill out the top section of the form with the name of your continuing credit union and the name of the merging credit union, along with the effective date of the merger.

- Enter the date of the executed merger agreement, which should match the date when the Board of Directors adopted the resolution for the merger.

- Confirm that all required steps for the merger have been completed by checking the appropriate box and detailing any necessary actions taken regarding the asset transfer of the merging credit union.

- Attach the requested documents along with the form. These include financial reports for each credit union prior to the merger, a consolidated financial report for the continuing credit union post-merger, the charter of the merging federal credit union (if available), the insurance certificate for the merging federally insured credit union (if available), and a copy of the executed merger agreement (Form NCUA 6304).

- Sign and date the certification section of the form, ensuring that both the designated Board Presiding Officer and Treasurer have signed it.

- Review the completed form for accuracy and completeness before proceeding to submit it by mailing it to the NCUA Regional Director as specified in the instructions.

- Once you have confirmed that your form is ready, you can choose to save changes, download a copy for your records, or print the document for mailing.

Complete your NCUA 6309 form online to ensure a smooth merger process for your credit union.

NCUA share insurance functions to protect member deposits up to the insured limit, much like FDIC insurance for banks. Under the Instructions For NCUA 6309: Within 30 Days After The Effective Date Of ... - Ncua, credit unions must adhere to specific guidelines to maintain this insurance. This protection guarantees that members' savings are secure, especially during uncertain times.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.