Get Federal Direct Stafford/ford Loan Federal Direct Unsubsidized ... - Direct Ed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Master Promissory Note online

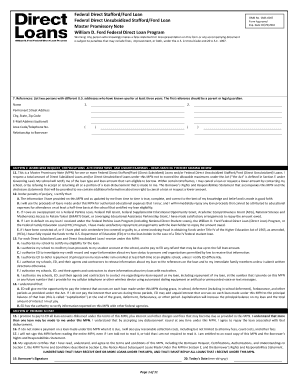

Filling out the Federal Direct Stafford/Ford Loan (Direct Unsubsidized) Master Promissory Note is a crucial step for students seeking financial assistance for their education. This guide provides comprehensive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Master Promissory Note accurately.

- Click the ‘Get Form’ button to obtain the Master Promissory Note and open it in your preferred online format or editor.

- In Section A, provide your driver’s license state and number. If you do not have a driver’s license, enter 'N/A'.

- Enter your nine-digit Social Security number in the designated field.

- Optionally, enter your email address if you wish to receive communications related to your loan.

- Provide your full name, ensuring you enter your last name first, followed by your first name and middle initial. Include your permanent address accurately.

- In Section B, your school will complete predefined fields regarding your loan eligibility.

- In Section C, carefully read items 11 to 14 regarding the borrower's request, certifications, authorizations, and understandings.

- List two references with different U.S. addresses who have known you for at least three years, ensuring one is a parent or legal guardian.

- In Section D, read and complete the promise to pay section by acknowledging you understand the terms and your commitment.

- Sign your full legal name in blue or black ink followed by the date you are signing the document.

- Finally, review all provided information for any inaccuracies, make corrections if needed, and save your changes to the Master Promissory Note. You can then download, print, or share the completed form as necessary.

Complete your Federal Direct Stafford/Ford Loan Master Promissory Note online today to secure your educational funding.

Applying for a Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized loan involves several straightforward steps. First, complete the FAFSA to establish your financial need. After that, contact your school's financial aid office to discuss the award process. They will guide you through the necessary paperwork and ensure you understand the terms and conditions of your loan.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.