Loading

Get Nc 99003 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc 99003 Form online

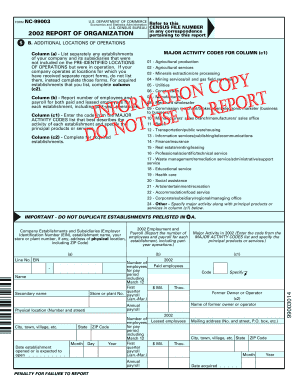

The Nc 99003 Form is a crucial document for reporting the organization and employment details of various establishments. This guide provides a step-by-step approach to filling out the form online, ensuring that users understand each section clearly.

Follow the steps to successfully complete the Nc 99003 Form online.

- Click ‘Get Form’ button to access the form and open it in your browser.

- Begin with section B, where you will need to list any additional locations of operations for your company. For each establishment, ensure to include the company name, physical address, and EIN (Employer Identification Number).

- In column (b), input the total number of employees and payroll figures for both paid and leased employees for each location specified in column (a). This includes part-year operations, so be thorough in your reporting.

- For column (c1), find the corresponding major activity code that best describes the business activity of each establishment and enter it accordingly. Additionally, specify the principal products or services offered at each location.

- If you are reporting for acquired establishments, complete column (c2) with the name of the former owner or operator and any relevant details regarding the status of the establishment. Ensure that you also enter the date the establishment opened or is expected to open.

- Once all sections of the form are filled out accurately, review your entries for any mistakes or omissions before proceeding.

- After confirming the information is correct, you may save the changes, download the completed form, print it, or share it, as required.

Complete your Nc 99003 Form online today for an efficient reporting process.

You must file taxes if you earn at least $600 reported on a 1099 form in a tax year. This threshold applies to non-employee compensation and several other types of income. Even if you earn below this amount, it's often beneficial to file. For clarity and organization regarding your earnings, consider referring to the Nc 99003 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.