Loading

Get Form No 5 5404

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 5 5404 online

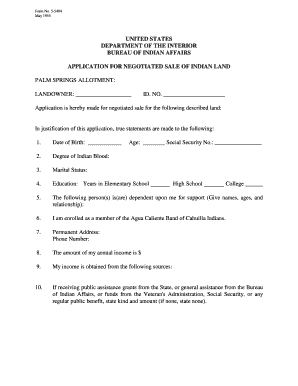

Filling out the Form No 5 5404 for the negotiated sale of Indian land can be a straightforward process when approached step by step. This guide is designed to provide clear instructions for users, ensuring a smooth online completion of the form.

Follow the steps to complete the application effectively.

- Click ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin by entering the name of the landowner in the designated field.

- Input the ID number associated with the landowner.

- Describe the specific land being sold in the section provided.

- Answer questions regarding your date of birth, age, and social security number.

- Indicate your degree of Indian blood and your marital status.

- Provide information about your education, including the number of years completed in elementary school.

- List the names, ages, and relationships of any persons dependent on you for support.

- Confirm your enrollment as a member of the Agua Caliente Band of Cahuilla Indians.

- Enter your permanent address and phone number.

- State your annual income and specify the sources from which this income is derived.

- If applicable, disclose any public assistance grants or benefits you are receiving.

- Mention any indebtedness to the United States, providing the amount and purpose.

- State whether you reside on the land or use it personally and provide details about leasing, if applicable.

- Explain your intended uses for the land after receiving the patent and what you plan to do with the sale proceeds.

- Choose whether you wish to retain mineral rights by indicating your choice in the provided section.

- Once all fields are completed, review the information for accuracy before signing.

- Sign and date the application at the end to certify its accuracy, then submit your completed form.

Complete your Form No 5 5404 online today for a hassle-free filing experience.

You typically need to file Form 5405 only if you qualify for certain tax credits associated with first-time home purchases. This form is often submitted in conjunction with your main tax return, such as when filing Form No 5 5404. To stay compliant and make informed decisions, check the US Legal platform for updated information and guidance on filing requirements related to this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.