Loading

Get Form 5792

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5792 online

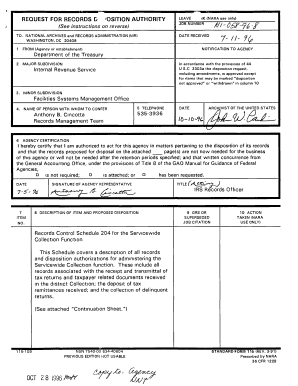

Filling out Form 5792 is essential for managing records related to tax operations. This guide will walk you through the steps to complete this form online, ensuring that you understand each section and field.

Follow the steps to complete Form 5792 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date received in the designated field, usually at the top of the form.

- Fill in the name of the agency or establishment from which you are requesting records, ensuring that the correct agency name is input.

- Provide the specific subdivisions relevant to the records you are requesting in the appropriate sections.

- Include the telephone number of the person with whom to confer, ensuring it's accurate for any follow-up.

- The agency representative must certify their authorization to act on behalf of the agency and fill in the date signed.

- Complete the item number and title sections to specify the records you are seeking.

- Describe the items and proposed disposition carefully in the required description section.

- After completing the form, review all entries for accuracy before proceeding to save, download, or print.

- Finally, save your changes and choose to download, print, or share the completed form as needed.

Complete your Form 5792 online today to ensure efficient records management.

Yes, you can file your own tax refund without needing a professional, provided you feel comfortable navigating the forms and instructions. Make sure to include all necessary documentation and check for any errors before submitting. By using uslegalforms, you can also access templates and guides to assist you with Form 5792.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.