Loading

Get Ca Ang Form 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA ANG Form 4 online

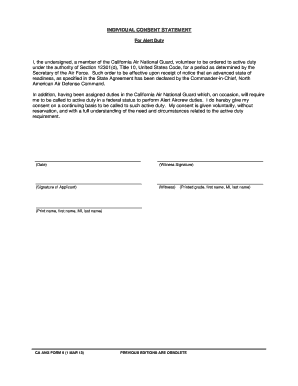

Completing the California Air National Guard Form 4 online is essential for members who wish to give their consent for active duty under specific conditions. This guide provides step-by-step instructions to help users navigate the form easily and accurately.

Follow the steps to complete the CA ANG Form 4 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred document editing tool.

- Begin filling out the form by entering the date at the top section. This information is crucial for the validity of your consent.

- Next, you will need to provide your printed grade, first name, middle initial (MI), and last name in the designated fields. Ensure that your name is accurately represented as it appears in official records.

- In the section pertaining to consent, carefully read the statement regarding your willingness to be ordered to active duty. Acknowledge that your consent is given voluntarily with a full understanding of the requirements.

- Sign the form where indicated to officially give your consent. This signature must match the identity you provided in earlier sections.

- You will also need a witness to your signature. The witness should sign and print their name as required on the form.

- Review all entries for accuracy. Once confirmed, save your changes or download the form for your records. You may also choose to print or share the completed document as needed.

Complete your CA ANG Form 4 online today and ensure your readiness for active duty.

If you have lost your W-4, don’t worry; you can easily request a new one from your employer. Simply fill out a new W-4 form and submit it for processing. It’s crucial to keep your W-4 updated to reflect changes in your financial situation. If you’re uncertain about filling it out correctly, consider using resources from USLegalForms for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.