Get Transfer Another 529 Plan To The Usaa College Savings Plan. Use This Printable Pdf Form.

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Another 529 Plan To The USAA College Savings Plan. Use This Printable PDF Form. online

This guide provides detailed instructions on how to complete the Transfer Another 529 Plan To The USAA College Savings Plan form online. By following these steps, users can ensure a smooth transfer process for their educational savings.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

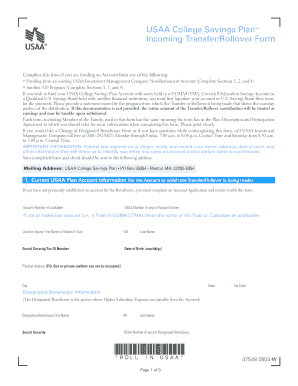

- Begin by filling out your current USAA plan account information in Section 1. Indicate how you would like to register your account, and provide your account number if available. Include your USAA number, the owner's name, social security or tax ID number, date of birth, and physical address. Ensure to print clearly.

- If you are funding from an existing USAA Investment Management Company account, complete Section 2. Select the type of account from which you are transferring funds and provide the respective account numbers along with the desired amounts.

- For transfers or rollovers from another 529 program, fill out Section 3. Indicate how you wish to register your new account and provide the required documentation stating the earnings portion of the withdrawal. Note that the transfer or rollover must occur within 60 days of the original withdrawal.

- In Section 4, you must sign the form, certifying the information is accurate and that you understand the consequences of the transfer or rollover. Ensure to include the date and, if necessary, a signature guarantee.

- Once all sections are completed, review the form to ensure accuracy. Users can then save any changes, download the filled form, print it, or share it as needed.

Complete the Transfer Another 529 Plan To The USAA College Savings Plan form online to ensure your educational savings are effectively managed.

The 529 loophole refers to the ability to use 529 plan funds for certain expenses, such as private school tuition or college costs, without incurring taxes. This allows families to strategically plan their educational finances. By understanding this loophole, you can maximize your savings potential when you transfer another 529 plan to the USAA College Savings Plan. Be sure to use this printable PDF form to facilitate your transfer process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.