Loading

Get Hra Claim Form 1009r.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HRA Claim Form 1009R.doc online

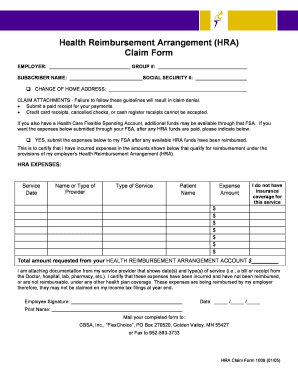

Filling out the Health Reimbursement Arrangement (HRA) Claim Form 1009R is essential for ensuring that you receive reimbursement for eligible healthcare expenses. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the HRA claim form online

- Click the ‘Get Form’ button to access the HRA Claim Form 1009R and open it in your preferred editor.

- Begin by entering your employer's name and group number in the respective fields at the top of the form. This information is crucial for processing your claim.

- Fill out your name as the subscriber along with your social security number. Ensure that your information is accurate to avoid processing delays.

- If you have changed your home address recently, check the box and provide your new address to keep your records up to date.

- In the claims attachments section, make sure to mention that you have attached a paid receipt for your payments. Remember that credit card receipts, canceled checks, or cash register receipts will not be accepted.

- If applicable, indicate whether you wish to have the expenses submitted to your Health Care Flexible Spending Account (FSA) after any available HRA funds have been reimbursed by checking the yes box.

- List all incurred expenses in the designated HRA Expenses section. For each entry, provide the service date, name or type of provider, type of service, patient name, and the expense amount.

- If you do not have insurance coverage for any of the services listed, indicate this by checking the appropriate boxes.

- Once all sections are completed, calculate the total amount requested from your HRA account and enter this amount in the given field.

- In the signature section, confirm that you are attaching the necessary documentation from your service provider that supports your claims for reimbursement.

- Finally, sign and date the form before submitting. You can choose to save any changes, download the filled form, print it for records, or share it as needed.

Complete your HRA Claim Form 1009R online today to ensure you receive your healthcare reimbursements promptly.

Yes, if you are filing 1099-NEC forms with the IRS, electronic filing is generally required for businesses with large volumes. However, you can file smaller numbers by mail. Consider using the HRA Claim Form 1009R.doc to streamline your filing tasks, ensuring that you remain compliant with the IRS requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.