Loading

Get Irs Salary

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Salary online

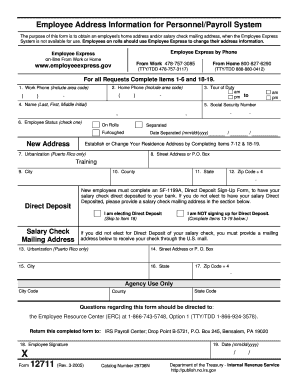

Filling out the IRS Salary form is a crucial process for ensuring that your address and payment information are correctly recorded. This guide will provide you with step-by-step instructions to navigate the form with ease, ensuring that you complete each section accurately.

Follow the steps to fill out the IRS Salary form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Complete Items 1-6 and 18-19, providing necessary contact information. Input your work and home phone numbers, your name, and social security number, and indicate your employee status.

- If establishing or changing your residence address, fill out Items 7-12. Provide your urbanization (if applicable), street address or P.O. Box, city, state, county, and zip code.

- If you are opting for direct deposit, you can skip to Item 18. Otherwise, fill in Items 13-19 with your salary check mailing address, including urbanization (if applicable), street address, city, state, and zip code.

- Sign the form in Item 18. Ensure that you date the form in Item 19 for completion.

- Once all sections have been filled out, save your changes, and choose to download, print, or share the completed form as needed.

Complete your IRS Salary form online today for a streamlined process.

Calculating your IRS income involves summing all sources of income you receive over the year. This includes your salary, bonuses, and any freelance income. After determining your total income, subtract any eligible deductions to find your taxable income. Utilizing IRS guidelines or tax software can streamline this process and ensure accuracy when reporting your IRS salary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.