Loading

Get 13614 C

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 13614 C online

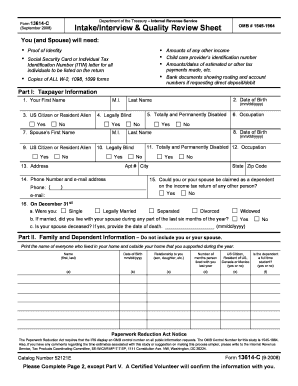

The 13614 C is an important document for taxpayers preparing to file their tax returns. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can navigate each section confidently.

Follow the steps to effectively complete the 13614 C online.

- Press the ‘Get Form’ button to access the 13614 C form and open it in the preferred editor for online filling.

- Begin by providing your personal information in Part I. This includes your first name, middle initial, last name, and date of birth. Ensure all information is accurate and matches your identification documents.

- Indicate your citizenship status by selecting the appropriate option for yourself and your spouse if applicable. This is critical for tax filing eligibility.

- Record your contact information, including your phone number and email address, which may be needed for communication regarding your tax return.

- In Part II, list the family members and dependents you supported during the year. Include their names, dates of birth, relationships to you, and residency information.

- Move to Part III to declare any income received during the year, including various types of income such as wages, unemployment benefits, and other sources. Make sure to confirm this information aligns with your income documents.

- Proceed to Part IV to specify any expenses incurred, including medical expenses, educational costs, or alimony payments. This information can affect potential deductions.

- Confirm that all sections have been completed accurately and double-check all entries for correctness before proceeding.

- Finally, save your changes and choose whether to download, print, or share your completed 13614 C form as needed for submission.

Complete your 13614 C form online today to streamline your tax filing process.

Schedule C is generally required for sole proprietors reporting income from self-employment. If you operate as an independent contractor or run a business as an individual, you must fill out this schedule accurately. By including the necessary details on Schedule C, you can effectively report your business income and expenses, ensuring compliance with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.