Get Irs Form 4v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form W-4V online

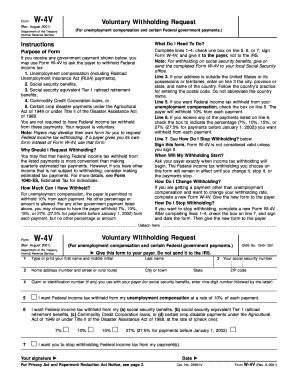

Filling out the IRS Form W-4V, which is a Voluntary Withholding Request, can be a straightforward process when done online. This guide will provide you with clear and helpful instructions to ensure that you successfully complete the form for unemployment compensation and certain federal government payments.

Follow the steps to effectively fill out the form online.

- Click ‘Get Form’ button to obtain the W-4V form and open it in the editor.

- On line 1, type or print your first name and middle initial, followed by your last name. Ensure that your name matches the records on file with your payer.

- On line 2, enter your social security number. This information is essential for processing your request for withholding.

- On line 3, fill in your home address, making sure to include the number and street or rural route, city, state, and ZIP code. If your address is outside the United States, include the country name without abbreviations.

- Enter your claim or identification number on line 4, if applicable. For social security benefits, this would be the nine-digit number followed by the letter.

- On line 5, check the box if you want federal income tax withheld from your unemployment compensation at a rate of 10%.

- On line 6, select the appropriate box to indicate your choice for withholding from other payments, either 7%, 10%, 15%, or 27% (27.5% for payments made before January 1, 2002). Be sure to check only one box.

- On line 7, indicate if you want to stop withholding federal income tax from your payments by checking the corresponding box.

- Sign and date the form. Remember, the form is not valid without your signature.

- Once completed, save your changes, download the form, print it, or share it as necessary. Be sure to give the completed form to your payer, not to the IRS.

Start filling out your IRS Form W-4V online today to ensure your federal income tax withholding is managed accurately.

Common mistakes on the W-4V include incorrect personal information, failing to sign the form, and not specifying the right withholding amount. It is crucial to double-check all entries to avoid issues with your tax withholding. Using the IRS Form 4V correctly can help ensure that your Social Security benefits are taxed appropriately. If you find errors, correct them promptly to maintain accurate records.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.